6 Tips for first-time investment property buyers

Buying a property for investment purposes has grown in popularity over the years. This is due to a number of things including the popularity of homesharing and the growth of the rental economy, especially among the younger generations who don’t all wish to own assets, according to a Deloitte survey.

Even though we had an interest rate hike, the buy-to-rent market is still a good one to get into if you wish to use property as an investment.

Here are six tips for those wanting to go this route.

Choose your location wisely

“Location is one of the most important factors when purchasing an investment property,” says Wilmot Magopeni, Franchisee Leapfrog Sunshine Coast. “If you want to target students, you want a location close to universities. If you want to target workers, perhaps something close to the city would be best.”

Other things to consider when it comes to location would be how close the property is to public transport routes, what the closest shopping centres are and if there is a high demand for rentals in the area.

“If you find a property in a good area that’s not in the best condition, consider negotiating the price of it and use the extra money to upgrade the space,” advises Magopeni.

Be realistic with your expectations

“There are many landlords who have made a small fortune by purchasing investment properties, but that won’t be the case for everyone,” Magopeni notes. “The property market value isn’t growing at the rate that it once was, so manage your expectations before you make a final decision.”

The interest rate also impacts how much money - or rather profit - you make off rental every month after your bond payment is taken into account. It would be good to keep this in mind as we are due at least one more hike in the coming months.

Look outside of your comfort zone

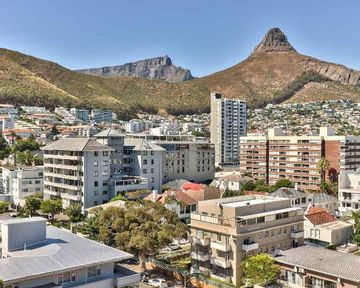

Don’t only consider properties in the city in which you live. Perhaps you can’t afford an investment property in the heart of Cape Town, for example, but that doesn’t mean you can’t afford a property in a prime location in another city.

This is why it's important to chat to a property professional and why a property group such as Leapfrog is perfect to help in this regard. With franchises all across the country, you could get tips on investment properties from all corners of Africa.

Budget for upgrades

Even if you think you’ve bought the best property, you will find that somewhere it could use an upgrade. It might not be as big as a full-on renovation, but the property might need a fresh paint, perhaps a new cupboard door or even new taps and other hardware.

“This not only adds value to your investment, but it will also make you feel as though you’ve put some of your input into the place,” says Magopeni.

Don’t take the first bond offer that comes your way

Shop around before signing a bond as you might find a better deal elsewhere. One offer might have better interest rates than the other, so don’t jump at the first one you receive.

Consider working with a bond originator who will be able to handle this process on your behalf. They do all the bank negotiations and will be able to advise on what the best offer on the table may be.

Let MyProperty help you find your perfect home loan

Enjoy the experience

Buying a property whether it be for investment or to live in is a massive step and it can be life changing. Be sure to enjoy the process of shopping around and taking this next big step.

“Celebrate the wins and once it’s all locked in, be grateful for the ability to invest in this manner,” Magopeni concludes.